Trump’s tax plan is seen as the “most significant tax overhaul since the Reagan Administration”. Trump and other Republicans are considering it an early Christmas present for the people of the United States. Trump calls it “a massive tax cut for the everyday, working Americans who are the backbone and heartbeat of our country”. House Speaker, Paul Ryan, claims they are “giving the people of this country their money back”. Kellyanne Conway, Counselor to the President, “(feels) great for all those forgotten men and forgotten women who are going to get a tax cut for Christmas and for New Years and for the holidays”. However, the extremely tight vote of this bill proves that not everyone is falling for the idea that this tax plan is supposed to advantage the middle-class workers of the United States.

The proof is in the paper: Trump can say that the purpose of this bill is to help working, middle-class Americans, but in reality, the biggest tax cuts are for corporations. In CNN’s analysis of this bill, it is shown that the ones who are being directly harmed in this bill are those who have Medicare (such as the elderly, for whom Medicare faces a 4% cut), and people buying health insurance, as “eliminating Obama’s original mandate could hike premiums”. And eventually, the tax cuts of individual earners will expire by 2025. Most often, those individual earners are middle-class workers — the exact type of people Trump and other Republicans claimed this bill would advantage.

Corporation’s tax rates are being cut from 35% to 21%. In an interview between Kellyanne Conway and CNN’s Chris Cuomo, Cuomo states that he believes this tax plan benefits corporations more than the middle-class, to which Conway responds, “Are you going to look at the middle-class right now and tell them that none of them are going to get a tax cut?” Cuomo refutes with, “No, I am saying they are not getting as good of a treatment as the upper tier and this was sold as advantaging them”. Cuomo also pointed out in this interview that this plan also harms students by taxing tuition and loans.

What is most ironic about this bill is the time of year. Trump considers this his Christmas gift to the people, but clearly almost half of the senators who voted on this bill see right through this plan as a Christmas gift to the wealthy. There are massive tax cuts for corporations while the tax cuts of individual earners will eventually expire and their health care is at risk of being taken away. Trump can put up a facade, but it is clear that the only ones he is ensuring tax cuts to are the big corporations. The heads of corporations are getting their Christmas present, but for the middle-class? Right around the time of year when people get sick, Trump is reducing Medicaid and has no plan to ensure their tax cuts will last in the long run.

The result of the vote for this bill was 227-203, in support of its passing. Three provisions in the bill were rejected, as “they violate budget rules”. The bill is expected to be voted on again by the House on Wednesday.

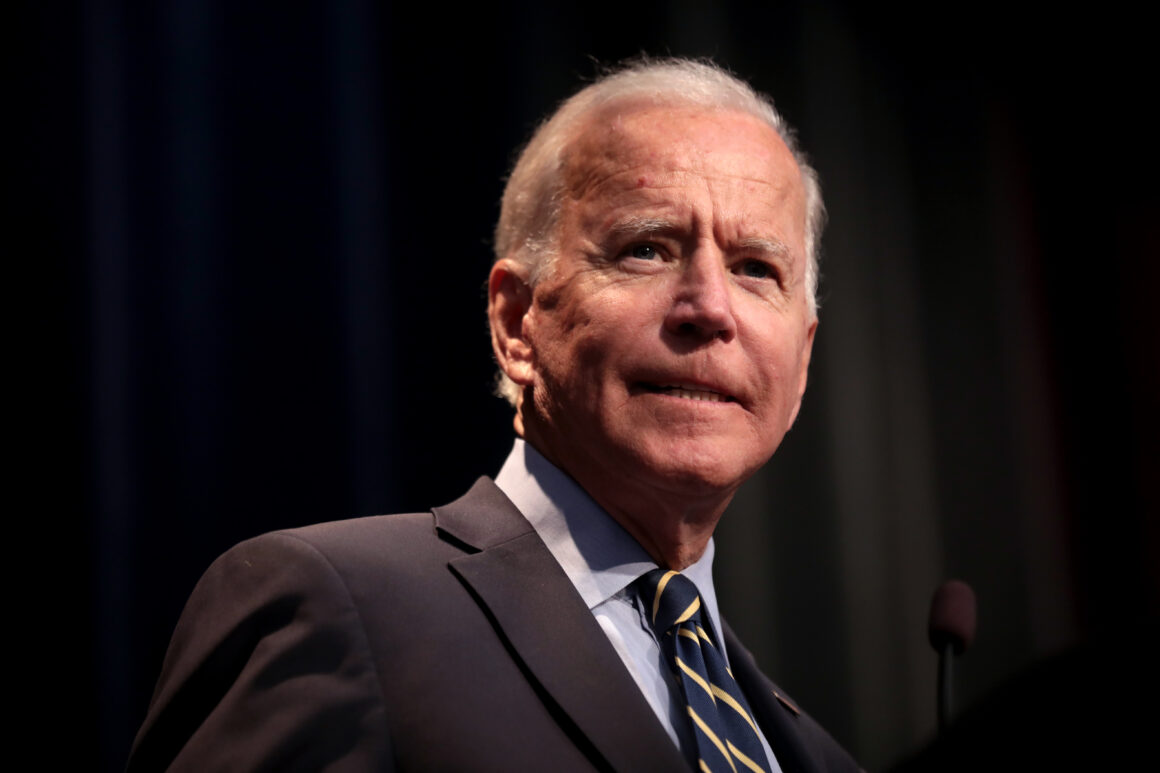

Photo: Sebastian Vital / Flickr