Now that their healthcare plan has failed (again), the Trump administration wants to move onto tax reform. In a speech to Indiana workers, President Donald Trump said “I’m doing the right thing and it’s not good for me” in regards to the new taxes he wants to implement. Sadly, his promise is completely false.

Trump’s plans shift the tax burden away from the wealthy. The Washington Post reports that the new tax code removes personal and dependent exemptions for the lower and middle classes. The article also cites public policy professor Lily Batchelder, who estimated in 2016 that “Trump’s plan would increase taxes for about 8.7 million families.”

The tax plan eliminates deductions at the state and local levels, which takes away relief from citizens in high-tax states. New York Magazine explains that in states like California and New York, “eliminating the deduction will impede — or even roll back — progressive gains at the state level,” such as free public college and paid family leave.

According to Bloomberg, Republicans want to cut the corporate tax rate from 35 percent to 20 percent; Trump wants to cut it even lower. Trump pushes for this while arguing that high taxes keep companies from investing in American workers.

However, most multi-national corporations do not pay the statutory rate. The various tax loopholes under our current system have allowed corporations to pay an 18.6 percent effective tax rate on average. Rather than trickling the money down back to the working class, cutting the official rate would guarantee that more companies will pay no federal income taxes.

The Center of Budget and Policy Priorities explains that wealthy individuals and companies keep the money gained from tax cuts and “would cost more than $2 trillion over ten years.” To add insult to injury, the CBPP says that the plan stops taxing corporations on foreign profits, which encourages the outsourcing of jobs and “could hurt U.S. workers’ wages and productivity.”

Worst of all, Trump would personally benefit from the giant tax cuts. The New York Times reported the tax plan would be “eliminating the estate tax, which affects just a few thousand uber-wealthy families each year, and the alternative minimum tax, a safety net designed to prevent tax avoidance.”

Repealing the estate tax benefits Trump’s children after he dies. Trump would also benefit from repealing the alternative minimum tax, since it cost him $31 million in his 2005 tax returns. The New York Times also reported Trump could save up to $1.1 billion total with this new tax policy.

Senator Bob Corker of Tennessee said “there is no way in hell I’m voting for it” but is one of few Republicans worried about the $2 trillion deficit the bill creates.

Trump’s proposal is a giant giveaway to the wealthy. This should not be any surprise coming from the man who said that he did not want a poor person in his cabinet, but the proposal is far too clear in how it crushes the neediest Americans. When his tax plan ignores the fact that 67 percent of Americans think corporations pay in taxes, Trump tells the American people that he is not looking out for their best interests.

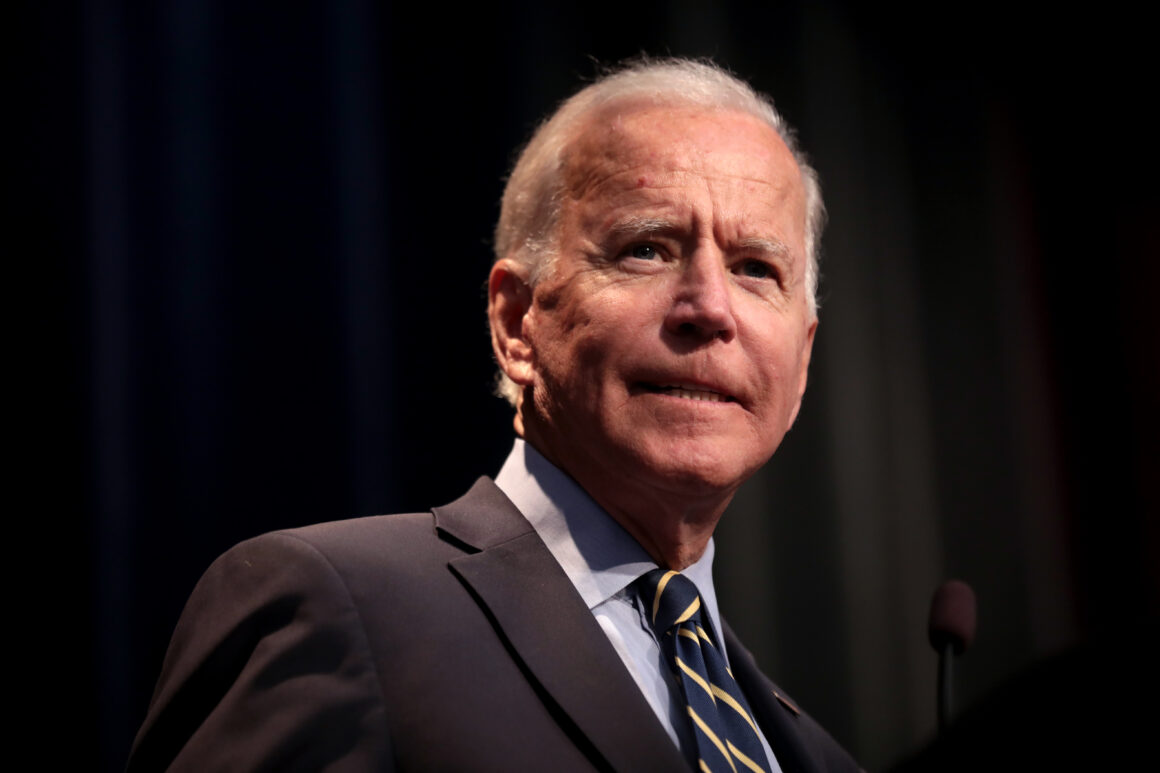

Featured Image: ABC News