In the early hours of Saturday morning, the Senate passed its tax reform bill with a narrow 51-49 vote. The vote was mainly along party lines, with Sen. Bob Corker of Tennessee being the only Republican Senator to vote against the bill.

In the final moments before the vote, democratic negotiators were continually making changes to the bill in an attempt to create a bill that was less favorable to the top 1% of the country. Many of the revisions were handwritten directly on the document due to the lack of sufficient time given to members.

Democrats criticized Republicans for this, claiming that it was impossible for senators to read and comprehend such a significant piece of legislation in such a short period of time. Senate minority leader, Sen. Chuck Schumer, told The New York Times that the process of passing the bill and the bill itself are things “no one can be proud of and everyone should be ashamed of.”

Republicans claim the bill will be a middle-class tax cut that immediately cut taxes for 70 percent of middle-class families. In doing so, it will raise taxes on millions of other families through elimination of deductions of state and local income taxes and phasing out of individual tax cuts by 2025.

It is the corporations, however, that will benefit the most from this tax reform bill. Corporate tax rates will be cut from 35 percent to 20 percent permanently. As a last-minute deal to bring two undecided senators to vote yes, Republicans added a provision that will largely cut taxes for the owners of smaller companies that are not organized as traditional corporations.

Although the passage of the bill on the Senate floor is a huge victory for the GOP, the bill hasn’t been signed into law yet. As the House passed their version of the bill, the two chambers are set to conference to reconcile the bills before the final bill is signed by the President. We can only hope that, for the sake of current and future generations of Americans, the bill will never reach the hands of the President.

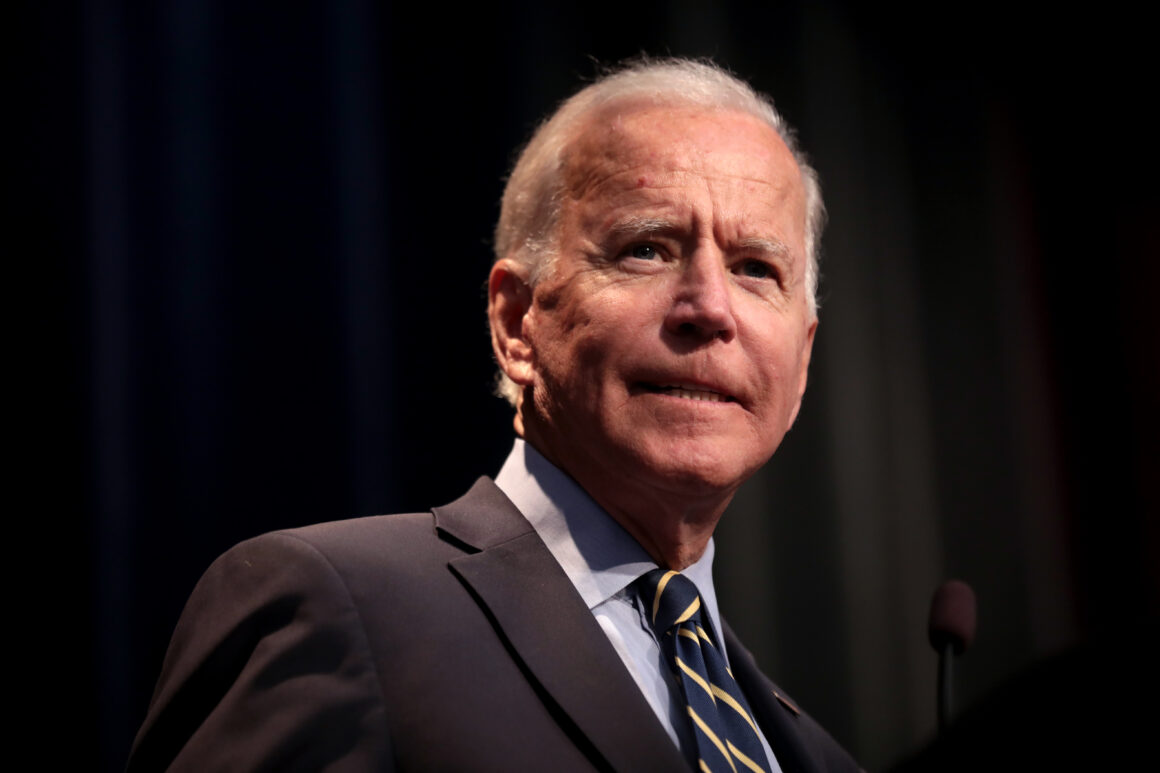

Photo J. Scott Applewhite / AP